Indonesia’s second-tier cities on the move

Indonesia is the world's largest archipelago with an area of nearly 2 million square kilometers. It consists of five major islands, namely Sumatra, Java, Kalimantan, Sulawesi, and Papua, and is divided into 34 provinces. Based on the latest numbers in 2016, 258 million people are living in Indonesia, making it the fourth most populated country in the world.

Indonesia has charted impressive economic growth since the 1990's. Over the last decade, Indonesia recorded an average GDP growth of 5.6% annually. In terms of purchasing power parity, the country is the world's 10th largest economy.

Indonesia's population is young and quickly growing, and the nation's rapid urbanization makes it one of the fastest emerging consumer markets in the world. Between 2000 and 2015, the share of the population that lives in urbanized areas rose from 42% to 54%, now totaling 138 million people. This number is expected to rise even further. By 2030, 71% or 209 million people are forecasted to live in urbanized areas.

Along with this goes a growing middle class. GDP per capita has steadily risen, from USD 2,500 in 2006 to USD 3,900 in 2016, corresponding to a compound annual growth rate of close to 5%. Currently, Indonesia's middle class consists of 55 million people, with another 31 million expected to move up to that level by 2030.The country's improving macro-economic fundamentals such as, among others, rising GDP, growing income, an emerging middle-class, strong urbanization, and rising infrastructure investment figures have provided ample reasons for investors to move into the market and to benefit from the arising opportunities. The capital of Indonesia, Jakarta, with its population of 10 million people and an average economic growth of 6.3% over the past five years has already been attracting many global investors, paving the way for other Indonesian cities to follow.

The current Asia Insights takes a deeper look into Indonesia's most promising second-tier cities and examines which of them exhibit the highest potential for becoming Indonesia's next real estate investment opportunities.

Indonesia's leading second-tier cities

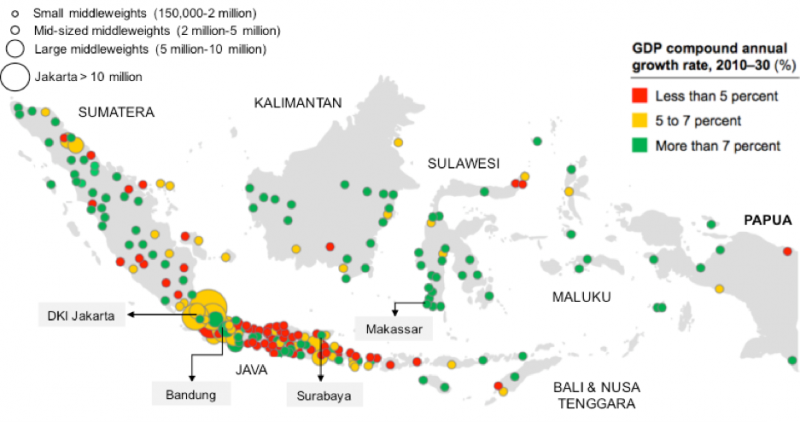

Figure 1 shows a map with an overview of Indonesia's cities qualified by their expected size and GDP growth. It strikes that by 2030, it is expected that there will emerge a large number of cities with a population of at least 2 million (as a comparison Europe has currently only 10 such cities). The map also shows that many cities are expected to achieve economic growth of 7% per annum or more. Naturally, some of these cities come from a low base, which needs to be taken into account when assessing their growth potential.

Figure 1: Indonesian cities by population and annual GDP growth rate until 2030

Focusing on these two statistics and taking other criteria such as infrastructure investment, trade, resource availability, education, geography, and political importance into consideration, three cities are of special interest: Surabaya, Bandung, and Makassar as the capitals of East Java, West Java, and South Sulawesi respectively.

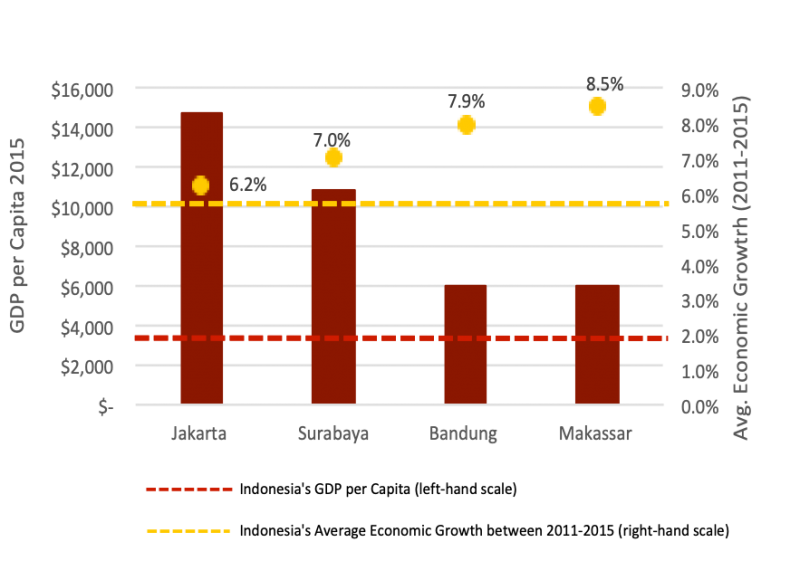

Figure 2 shows the economic performance of Jakarta and these cities as GDP per capita in 2015 as well as their average economic growth from 2011 to 2015.

Figure 2: Economic performance of Bandung, Surabaya, and Makassar in comparison to Jakarta

Each of the cities exhibits an above average GDP per capita level as well as above average economic growth. In line with demonstrating a lower base, the two cities that are lagging in GDP per capita, Bandung and Makassar, achieved the highest growth rates with 7.9% and 8.5% respectively over the past 5 years.

Surabaya: the second largest city in Indonesia

Surabaya is the capital of East Java Province. With a population of 2.85 million people, it is Indonesia's second largest city.

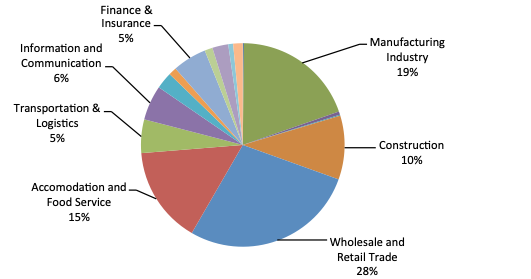

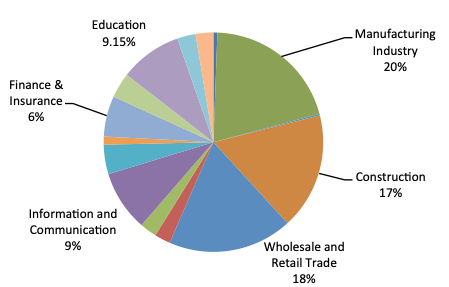

Surabaya's diverse economy provides a solid basis for rising prosperity and minimizes its risk exposure to sudden changes in single industries. Figure 3 shows the contribution of different industries to the region's economic output.

Surabaya benefits from progressive leadership. In 2010 the city appointed its first female mayor. She has led the region to achieve multiple international awards, one being the "ASEAN Environmentally Sustainable City Award", for turning Surabaya into a green and clean city. Since 2006, the town has repeatedly been awarded the highest environmental awards among all Indonesian cities.

Figure 3: Contribution of different industries to Surabaya's GDP

Surabaya is home to one of the country's main commercial ports. Geographically, it plays a critical role in improving the flow of trade not only in Indonesia, but all across Southeast Asia. More than 3.2 million containers were turned over in 2015. As a comparison, Jakarta handled 6.4 million containers, and Hamburg, one of Europe's biggest shipping ports, handled 8.8 million.

The trade industry has led to a substantial influx of foreign companies, and along its economic progress there is an ongoing development of the region's infrastructure. In 2009 the "Suramadu" bridge, a 16-km crossway that connects Surabaya and Madura Island, was completed. Currently, the upgrade of the railway between the two largest Indonesian cities, Jakarta and Surabaya, is in planning, just as new local public transportation systems such as monorails and trams.

Spurred by improving macro fundamentals, residential, commercial, and hotel projects are experiencing increasing demand.Over the past four years real estate price growth has continuously been in the low double- or high single-digit numbers. As the city and its economy are evolving, relative growth naturally started to ease to a more sustainable growth rate. The dominant players in this market are local developers and the current projects include mainly middle to upper class residential projects with sales prices from USD 920 to 3,100 per square meter. Due to its large size combined with vibrant economic activity, the city of Surabaya is becoming increasingly attractive to domestic and foreign investors.

Bandung: a tourism destination and upcoming technology center

In 2015, Bandung counted approximately 2.5 million inhabitants and it is expected that by 2030 this number will rise to 4.1 million.

Located approximately 120 kilometers Southeast from Jakarta, the city has always been a weekend destination for wealthy people living in Jakarta.

Figure 4: Contribution of different industries to Bandung's GDP

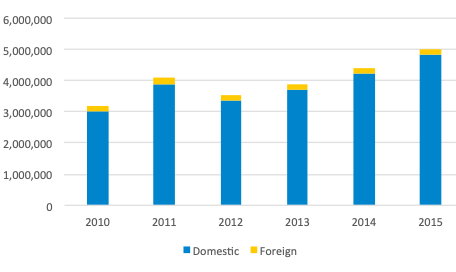

Next to the historically strong wholesale and retail trade (see figure 4), which has consistently dominated the city's economy, its cooler climate and fascinating nature make it one of the most popular destinations for Indonesian travelers. Figure 5 shows that between 2000 and 2015, the number of visitors grew at about 10% per annum, dominated mainly by visits of domestic tourists.

Bandung's ambitious mayor has developed the city into a thriving hub for manufacturing businesses and is positioning it now as Indonesia's leading technology center. With USD 800 million investments planned for a new satellite city named "Technopolis" in East Bandung, the mayor envisions the area to become the Silicon Valley of Indonesia. Consequently, the local government has started to develop Bandung's infrastructure extensively. In 2016, the construction of a new Light Railway Transit (LRT) line has started, connecting commuters between Jakarta and Bandung in just 30 minutes. The line is scheduled for completion in 2020 and signifies a pivotal impulse for the city's economic development. In pursuit of unraveling traffic congestion, the city initiated the development of the 27-km long Bandung Intra Urban Toll Road. The region also has an international airport, which has been under renovation since early 2016 and is expected to open this year.

Figure 5: Visits in Bandung by domestic and foreign tourists

Along with the improvement of the infrastructure, the city is not only becoming increasingly popular among domestic tourists and young businesses, but also among Indonesian residents. The demand for residential and leisure properties is increasing considerably, which is reflected in the local real estate prices. Prices saw an increase of 6.3% last year and now range from around USD 900 to 3,400.

Over the past four years, Bandung's real estate prices have steadily grown by an average of 7% yearly. Indonesia's largest property developers have started to seize the opportunity of this growing demand and are investing in the region. Similarly to Surabaya, the residential development projects cater towards the middle to upper class market.

Makassar: the gateway to East Indonesia

Makassar is East Indonesia's largest city with a population of 1.44 million people. It is one of the country's busiest hubs connecting Sumatra, Java, Bali, and Kalimantan in the West and Sulawesi and Papua in the East.

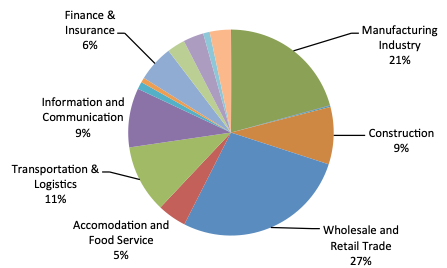

The city benefits from its strategic location and has been propelled by strong wholesale and retail trade. It has been a center for trading and shipping for Southeast Asia over centuries. Further, the manufacturing and construction industries contribute substantially to the city's success. Figure 6 outlines the different industries' contribution to the region's economic output. Mainly due to an increase in productivity, the economy of South Sulawesi's capital has been able to grow at 8.5% per annum over the last five years.

The city is on its way to becoming an increasingly internationally exposed metropolis. In 2016, for example, the local government signed a memorandum of understanding with the International Enterprise (IE) Singapore – an arm of Singapore's Ministry of Trade and Industry – to facilitate collaboration in order to develop a "smart city" that focuses on innovative urban planning and technology solutions.

Figure 6: Contribution of different industries to Makassar's GDP

Makassar follows Indonesia's president Jokowi's initiative to reform the country's transportation infrastructure. Eight main projects entailing substantial investment have been initiated, such as a USD 250 million investment for a 40 kilometer Highway, a USD 530 million railroad construction, a USD 900 million investment to expand Makassar's port to five times more container turnover capacity, and a new university. The region's uprising has started to take effect on its investment climate. Along with the growing economic development, the government has issued favorable policies to attract investors, including the facilitation of land procurement processes, improved legal security, and reduced taxes. Hence, Makassar witnessed accelerating urban development and a growing construction sector. The city's urban landscape is increasingly characterized by new business districts, shopping centers and hotels, and apartment complexes to cater to the inhabitants' demand. House prices are comparable to those of the other two examined cities with an equally positive outlook for future price appreciation. Due to Makassar's historical importance in the region and with further substantial infrastructure investment planned, the town's further development plans seem realistic and make it a favorable location for property investment in the near- to mid-term future.

Implications for investors

Surabaya, Bandung and Makassar stand out not just by quantitative criteria, but also by qualitative observations such as willingness of the local government to drive change. All three cities make an interesting case not only because of the rise in economic activity and the uptick in demand for property, but also by the common goal to provide better living conditions and an improved environment for both domestic as well as foreign investors.

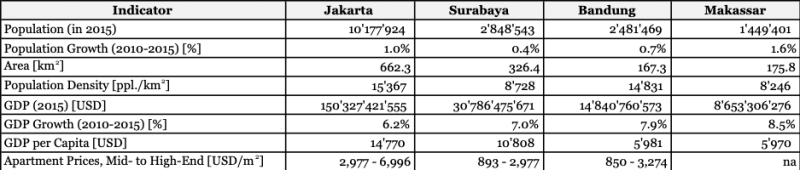

As indicated in figure 7, the cities' populations range from one quarter to one sixth of Jakarta's. While Bandung is as densely populated as Indonesia's capital, Surabaya and Makassar have only about half as many inhabitants per square kilometer. In terms of total GDP, Surabaya is the strongest among the three second-tier cities with about a fifth of Jakarta's total economic output. However, on a per person basis, Surabaya reaches already roughly 70% of Jakarta's GDP per capita.

Figure 7: Overview of the three examined cities in comparison to Jakarta

Judging each city by comparison to Jakarta, it is evident that none of them are quite at the level of the nation's capital yet. However, the growth rates of the second-tier cities are exceeding the one of Jakarta, signalling that they are catching up quickly. Supported by a nation-wide plan to improve infrastructure and the overall economic environment, several Indonesian cities manage to position themselves well to benefit from this process. Next to the country's capital, they are continuing to drive the nation's impressive growth story and are providing sustainable ground for the growth of the economy to continue. Investors increasingly widen their scope and look for opportunities in these second-tier cities of Indonesia, the dominant country in Southeast Asia.

Sources

ADB; asean.org; Bloomberg; CB Richard Ellis; China Daily; CEIC; Centaline; CitiBank; Colliers International; Credit Suisse Research; Cushman & Wakefield; Deloitte; Diener Syz Real Estate; DTZ Research; Economist Intelligence Unit; Financial Times; Franklin Templeton; Frost and Sullivan; GaveKal Dragonomics; IMF; institute for building efficiency; Jakarta Post; Jones Lang LaSalle; Knight Frank Research; KPMG; LaSalle Investment Management; McKinsey Global Institute; Morgan Stanley Research; National, Provincial, and Municipal Bureaus of Statistics; Nomura Research; OECD; People's Bank of China; Political & Economic Risk Consultancy Ltd; PricewaterhouseCoopers; Reuters Real Estate; Savills; Shanghai Daily; Thomson Reuters; Trading Economics; UBS Research; UN; Wall Street Journal; WTO; World Bank; World Energy Outlook (IAE); Xinhuanet

Our complimentary publications inform you about current developments in the Asian real estate market and key trends in the real estate industry. Sign up to receive them automatically.