EDGE – the World Bank’s green building initiative and its impact on Asia

It has long been established that buildings are responsible for over one third of all resource consumption and greenhouse gas emissions. With real estate being the biggest asset class, sustainable investing in property seems like an obvious thing to do. Like so often, however, the real challenge lies in the execution, and in particular in the credible assessment of true sustainability.

Sustainable investing has come a long way. With 26% of all global assets in 2016, equaling USD 22.89 trillion in total, more than one quarter of all assets under management are now being invested according to sustainable investing standards. Some of the largest institutional investors such as the Government Pension Investment Fund of Japan, Norway’s Government Pension Fund Global, or the Dutch pension fund ABP are investing according to environmental, social, and governance (ESG) principles. Sustainable investments have come to be the mainstream and they are increasingly seen as standard instead of an alternative way of investing. As investors start asking the question “why not” rather than “why”, their strategies have become more proactive from the early ethics-based, secluded, and negative screening approach to incorporating ESG criteria into the fundamental investment process, which is maximizing risk-adjusted returns. There is little doubt that sustainable strategies will gain even more traction across the investment industry, a process which is being driven by further adoption, continuing support from policy-makers, and alliances taking initiative in favor of a more sustainable world. One such example is the investor group Climate Action 100+, representing USD 26.3 trillion, pledging to engage with 100 corporations that are presumed to be responsible for approximately 85% of global greenhouse gas emissions in order to improve governance, curb emissions, and strengthen climaterelated financial disclosures. Another example of the issue also being addressed at a high-level includes the Global Responsibility Initiative (GRI) invoking a global standard for sustainability reporting. Further, the World Bank, as an example for leadership in sustainability and as a more rigorous measure, has announced in December 2017, that it will completely terminate the financing of oil and gas exploration by 2019. It has long been established that buildings are responsible for over one third of all resource consumption and greenhouse gas emissions. Matching real estate – being the biggest asset class – with sustainable investment-seeking capital seems like an obvious thing to do.

Like so often, the real challenge lies in the execution. The value for climate change combat is only unlocked if it is made sure that the ideas are well executed. That is, in the case of real estate, when capital is effectively transformed into “sustainable concrete”. One initiative, that strives to implement green building measures in a very pragmatic way and has been gaining attention in the industry quickly, is the International Finance Corporation (IFC) World Bank’s initiative “Excellence in Design for Greater Efficiencies” (EDGE). In this ASIA INSIGHTS, we will take a look at what it entails and what the opportunities are for real estate investors looking for sustainable real estate investments in Asia.

Asia is the region with the biggest greenhouse gas savings potential

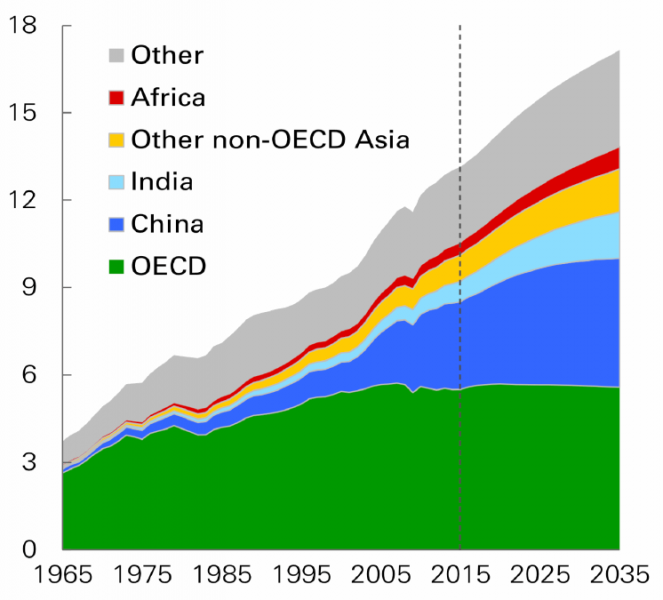

Greenhouse gas emissions stemming from Asia currently account for nearly 40% of all global emissions. Energy consumption in the region, which is directly linked to carbon dioxide output, is expected to further rise quickly over the next 15 to 20 years. Figure 1 shows the expected worldwide energy consumption separated by region.

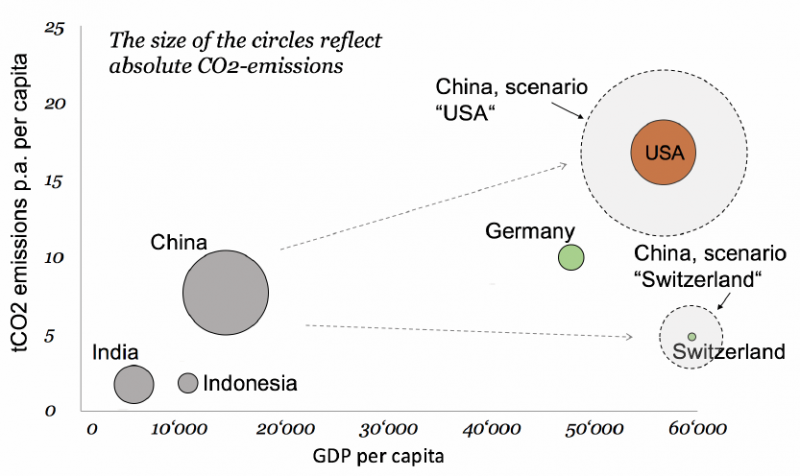

The chart highlights that Asia (China and India in particular) is the region with the highest expected growth rate in energy consumption. China alone has been estimated to release approximately 25% of the global total carbon dioxide today, approximately two times the amount of the US. Energy demand, as shown in Figure 1, is forecast to grow vastly until 2035, pointing out the very high likelihood that this share will increase drastically over the coming years. With its fast economic development and extensive construction activity, it is evident that the People’s Republic has a decisive and growing role regarding the combat of climate change. In Indonesia, as another example, the construction industry’s output grew by an average of 6.6% over the past few years. This number as well as other key economic indicators, such as the continuously strong GDP growth rate of around 5%, indicate that the country is developing at a similar pace than China. This situation prevails throughout most of Southeast Asia, which highlights the significance of a sustainable development of the region for the rest of the world. Asia’s sustainable development at cross-roads Most Western countries are economically further developed than their Asian peers and since new construction represents only a small fraction of the existing stock of buildings, more focus lies on proper retrofitting. Asian countries are mostly still in an earlier maturity stage and much of the attention lies on the construction of new buildings, which makes it a technically easier task to make an impact on the way buildings are designed, operated, and demolished. Many Asian countries are currently at cross-roads when it comes to shaping their future regarding their contribution to global warming. The graph below puts key indicators of the three largest Asian countries (China, India, Indonesia) into perspective with a few selected Western countries (USA, Germany, Switzerland). The size of the bubbles shows the relation between the countries with respect to their total CO2 emissions while the x- and y-axes show the countries’ differences in relative terms (GDP per capita and yearly per capita CO2 emissions.) The graph shows that the lesser developed Asian countries, measured in terms of GDP per capita, tend to emit relatively less CO2 per capita. With each citizen’s growing social welfare, rising mobility, and electricity consumption, relative CO2 emissions are likely to catch up with their Western peers. A brief look at the numbers confirms the thesis. Between 2010 and 2012, China contributed an estimated 73% of the growth in global carbon emissions and more than 50% of the global economic growth.

The two dotted bubbles in Figure 2 exemplify two scenarios for Chinas future path. The first scenario assumes the same emissions and GPD per capita as the US (China, scenario “USA”), while the second assumes the values per capita in Switzerland (China, scenario “Switzerland”). The size of each of the two dotted bubbles shows the absolute CO2 emissions under a scenario’s conditions and highlights the impact that China’s large population has on its absolute carbon dioxide output. China’s emissions are currently only a little less than two-fold that of the US, but with about four times of the population. Scenario “USA” shows, that if China’s per capita CO2 emissions were to rise to similar values as the US’, its absolute emissions would more than double, summing up to nearly five times the current emissions of the US. The threat of this happening is deemed real by researchers. A Harvard study from 2016 estimates that China’s emissions could rise by more than 50% already in the next 15 years, if no proper mitigation is enacted. If, however, proper mitigation measures are implemented and if China manages to decrease its per capita emissions to, for example, similar values than Switzerland, then Chinas total carbon dioxide output could even be cut in half. Then the total amount of emissions would equal that of the US, albeit the large differences in the size of the populations. Asia remains, not only economically, but also environmentally, the most pivotal region in the world. The importance of taking an effort to achieve a lowcarbon environment becomes imperative and it is left to governments to tackle the task with a focused and common vision – a challenge that has been acknowledged by Asian law-makers.

Policy-makers encouraging

Green Building adoption Albeit a later point in time than Western countries, awareness for the issue of climate change combat in the construction industry has found wide acceptance in the agendas of Asian policy-makers. In 2012, China’s central government has first issued an “Implementation Guidance on Accelerating the Development of Green Buildings in China”, which specified substantial subsidies for green-rated buildings. A “Green Building Action Plan” was put in place in 2013, putting forward the goal to complete one billion square meters of new green buildings during the term of the 12th Five Year Plan, shortly followed by several local initiatives. In 2014, the State Council issued “National New-Type Urbanization Plan 2014-2020”, which identified green cities as an important means to promote urbanization. The policy states that the proportion of green buildings in new construction should increase from 2% in 2012 to 50% by 2020. Encouraged by China’s willingness to drive change, similar developments have been set in motion in other Asian countries. The IFC, member of the World Bank Group, has engaged with multiple Asian countries to enhance green building policies and has, among others, supported the development of green building codes for Indonesia, the Philippines, and Vietnam. In Jakarta, the organization has guided the formulation of a new construction code for the city, which requires commercial buildings of a certain size to comply with strict green building criteria as part of the construction permit application process. Moreover, the Asia-Pacific Economic Cooperation (APEC) is working with all ASEAN countries (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, Vietnam) to drive green building adoption. In particular, the group has engaged in multiple projects striving to set standards and conformity assessment measures in order to enhance the performance and energy efficiency of the commercial building sector. It is safe to say that, in the meantime, proper policies and incentives have been set in place to pave the way for the adoption of sustainability measures within Asia’s real estate markets, which has already led to a tremendously higher proportion of green buildings. In 2015 in China, the area of green buildings totaled 320 million square meters, 154 times the figure of 2008. Nevertheless, the rate in Asia is still low with less than 1% of all floor space certified as green. As adoption is rapidly catching on the focus has shifted towards providing the right tools to effectively implement green building components in buildings.

The IFC World Bank’s “EDGE”

Many green building certification and consulting agencies have made it their goal to enforce sustainable thinking with property developers, owners, and occupants by setting up their own standardized evaluation systems. Most of these agencies are private, non-profit organizations and in their battle over market share they are facing some problems which are inherent when dealing with international and unequally developed real estate markets. Most of those private labels were created for countryspecific markets and, therefore, they are hard to compare internationally. To confront this issue, most of the top label agencies have forged sub-alliances with other leading labels in foreign markets or have instated “extensions” of their label with corresponding adaptions according to each foreign market. This has added to the complexity of the field. The colorful and scattered landscape with a variety of different certifiers in every country implies barriers for investors to take informed decisions. Hence, the labels are also not being reflected homogenously in valuation models. Moreover, most of the certificates entail tedious labelling processes that make it necessary to employ costly specialists. Another obstacle for broad-based adoption is that most labels target large-scale commercial properties only. The purpose of the IFC, as a member of the World Bank Group and an institution standing between the public and the private sector, is to invest and advise others in order to respond to the challenge of creating low-carbon economic growth. To advance green building construction in Asia’s real estate markets, the IFC has launched a new initiative, called Excellence in Design for Greater Efficiencies (EDGE), its own certification process for builders to enhance their designs and products. With the EDGE initiative, the IFC seeks to push the market forward toward a more sustainable real estate landscape. For a building to achieve EDGE certification, the simple goal is that it must achieve at least a 20% reduction in energy use, water consumption, and embodied energy in materials compared to a conventional building. A conventional building is defined by a comprehensive data set of projects and properties in various submarkets at the city-level. With more and more sustainable buildings added to the database (representing the market standard), the goal of beating the benchmark by 20% becomes harder and harder to reach. By employing this simple method the building stock overall is being improved, all at each single market’s own pace and irrespective of its development stage.

Why invest green?

Based on more than 100 interviews with investors a McKinsey study revealed that the three most common motivations for sustainable investing are enhancing returns, strengthening the risk management, and alignment of strategies with the priorities of beneficiaries. Green building provides a win-win situation for all involved stakeholders and provides substantial benefits for:

Tenants

- Higher indoor comfort

- Fewer sick-days of employees

- Higher productivity of employees

- Better learning conditions

- Improved well-being

Developers and investors

- Higher sales prices

- Higher rental rates

- Lower vacancy

- Lower operating cost

- Lower life-cycle cost

- Lower policy risk

Governments and society

- Lower CO2 emissions

- Reduced environmental cost

- Reduced water consumption

- Reduced waste production

- Reduced health cost

- Improved air quality

Sustainable buildings, if done right, provide high-quality spaces for humans to live and work in. At the same time, they deliver higher returns to investors and reduce health and environmental cost for the society.

EDGE certification is available in more than 130 countries and, thus, largely solves the issue of comparability for investors seeking to deploy capital in multiple markets. With EDGE, the IFC is building a large database containing, among others, material property specifications and associated cost, thereby easing the prevailing data scarcity regarding green buildings in Asian real estate markets. Since its inception in the beginning of 2015, close to 3.5 million square meters of building space have been certified with EDGE and the figure is growing quickly since the initiative’s roll-out in multiple countries.

Implications for investors

The demand for green buildings by occupants and investors in Asia has picked up substantially over the recent years as governments have provided the proper frameworks and incentives for it. Supply has also picked up, but is lagging demand with only a very small fraction of the building stock labelled green. It is likely that sustainable investments will experience further rapid growth in the investment industry, which leaves it up to the investors and developers to choose the right products and to make sure that the right tools are employed to obtain high-quality sustainable properties. With EDGE, the World Bank’s IFC has initiated a practical and non-country-specific approach to assess and implement green building measures. At the same time the IFC is working in close cooperation with governments to align private market interests with public rules and regulations. For investors seeking to invest in Asian real estate EDGE offers great potential to standardize the measurement of sustainability aspects of a property and is making them internationally comparable. The simplicity of the approach provides for lower barriers of entry to developers in the adoption of sustainability measures and should help provide investors with what they seek: sustainable investments. With EDGE, the IFC seems to have found a promising way to fulfil its self-proclaimed purpose and helps to ease the global warming potential stemming from the construction industry.

Sources

ADB; asean.org; Bloomberg; CB Richard Ellis; China Daily; CEIC; Centaline; CitiBank; CNN; Colliers International; Credit Suisse Research; Cushman & Wakefield; Deloitte; Diener Syz Real Estate; DTZ Research; Economist Intelligence Unit; Financial Times; Franklin Templeton; Frost and Sullivan; GaveKal Dragonomics; IMF; institute for building efficiency; Jakarta Post; Jones Lang LaSalle; Knight Frank Research; KPMG; LaSalle Investment Management; McKinsey Global Institute; Morgan Stanley Research; National, Provincial, and Municipal Bureaus of Statistics; Nomura Research; OECD; People’s Bank of China; Political & Economic Risk Consultancy Ltd; PricewaterhouseCoopers; Reuters Real Estate; Savills; Shanghai Daily; Thomson Reuters; Trading Economics; UBS Research; UN; Wall Street Journal; WTO; World Bank; World Energy Outlook (IAE); Xinhuanet

Our complimentary publications inform you about current developments in the Asian real estate market and key trends in the real estate industry. Sign up to receive them automatically.