The link between GDP growth and the real estate market

Supported by exceptional economic and business conditions, returns on equities and bonds during the past 30 years were considerably higher than the long-term trend. The high returns over the past decades in Western regions stemmed from declines in inflation and interest rates from unusually high levels in the 1970s and early 1980s, from strong GDP growth lifted by positive demographics, from productivity gains, and advances in automation.

Some of these trends have run their course and are noticeably weakening with the global investor community currently facing a situation where traditional fixed-income assets provide low or even negative yields.

In this "lower-for-longer" investment environment, real estate receives increasing attention as an asset class. For investors that can cope with illiquidity, global real estate still offers the desired investment characteristics: a steady, long-term income, the potential for capital appreciation, and significant diversification benefits. This has especially been the case in most Asian countries where structural, long-term, and sustainable economic growth has been persistent over the recent years. In fact, as GDP growth is the main driver of real estate prices and rents, real estate investments provide a direct way to participate in the strong growth of these economies.

This quarter's newsletter will focus on three things. First, a reality check should determine whether the Asian economic growth story is likely to continue. Second, the long-run link between GDP and real estate values, as well as rents, will be looked into, which should show whether real estate is likely to capture the supposedly strong growth of some economies. Third, a country-specific status quo of the commercial and residential real estate markets in Asian countries on a macro-level will qualify current investment conditions.

Will Asia keep leading global economic growth?

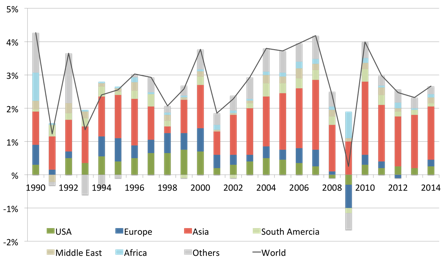

economy has intensified in the recent years. While in 2000 the region accounted for less than 30% of the world's output, by 2014 this share had risen to already 40% (as a comparison: Asia accounts for about 60% of the world's population). In terms of contribution to the annual growth, Asia accounted for nearly two-thirds of the global GDP increase in the last few years. Figure 1 outlines the composition of the world's GDP growth by region from 1990 to 2014.

Figure 1: Asia's persistently high contribution to global growth (real GDP growth in USD)

The figure highlights that even in times of global turmoil, such as the financial crisis in 2008, Asia has kept the world's economic growth above water. This not only shows the resilience of emerging Asia, but also draws attention to considerable diversification benefits in a global context.

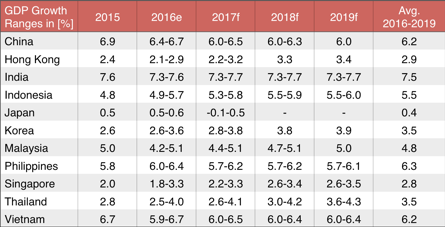

Most likely Asia will persist to expand its significance as a global economic power. This is underlined by current forecasts from various sources on GDP growth which are summarized in figure 2. The table includes the estimates of the Asia Development Bank, the International Monetary Fund, the World Bank, Focus Economics, and the Organization of Economic Co-operation and Development (OECD) for the current and upcoming years.

Figure 2: ongoing positive estimates for real GDP growth rates in Asia

Forecasts for the years 2016 to 2019 for all above countries (excluding Japan) range from 2.8% to 7.5%. This compares to the growth rates of approximately 2% for Europe and the US, which are further developed and, hence, exhibit less room for further appreciation.

The connection between GDP, income and real estate price

For residential real estate, the basic logic behind the co-integration of GDP growth and real estate capital returns arises from the fact that income has to be accumulated to buy a home. Income, in turn, can be directly derived from GDP with only a few adjustments. Studies in Asia, Europe, and the US reveal that median home prices correlate by as much as 60% to 95% with GDP per capita. In the long run the growth trends of both cycles typically correspond to each other. However, high correlation between GDP and real estate prices might not be given at all points in time. The prevalent real estate cycles do not always mirror GDP cycles, but often follow their own pattern. In the short and medium term real estate dynamics are not just driven by a country's prosperity and depend on other determinants. These are, for example, urbanization rates, construction activity and demographical changes which all influence supply and demand temporarily.

For commercial real estate, the logic is similar, but investors of commercial buildings – unlike homebuyers – typically evaluate investment properties with respect to their expected income and, therefore, commercial property prices experience a different cyclicality. In general, for investment property the price is a function of current income (cap rate), expected income, opportunity cost (discount factor) and capital value growth expectancy. However, it can be argued that all of these are again highly affected by GDP, albeit in a slightly different way, because economic growth drives demand for commercial spaces.

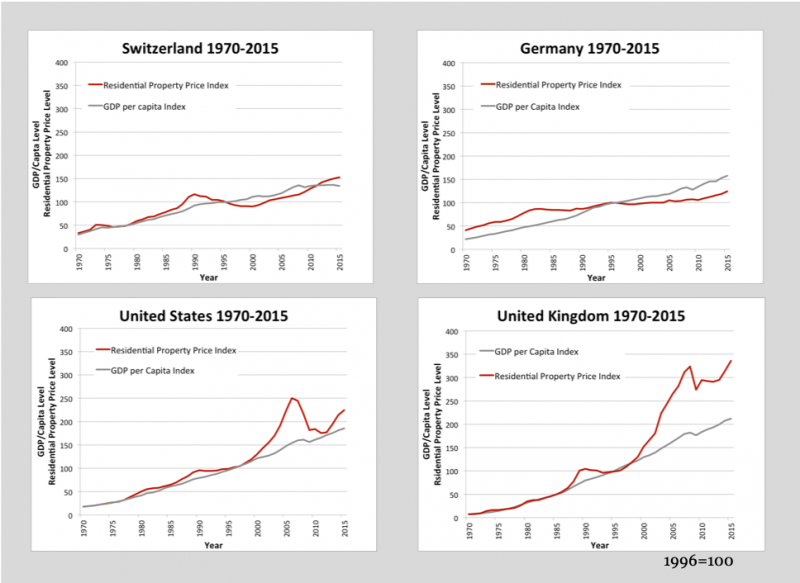

In sum, GDP can act as reasonable estimator for the progression of residential and commercial real estate markets. Figure 3 exhibits the nominal GDP per capita history as well as the mean residential real estate prices in nominal terms for Switzerland, Germany, the United States, and the United Kingdom. All indices cover the years from 1970 to 2015. The data was collected from central national banks.

Figure 3: the case for Western markets (GDP per capita vs. residential real estate prices)

A couple of statements can be derived. GDP and real estate indices, in the investigated sample, share a common movement. The figures show thecyclicality

of real estate prices with reversion to the GDP trend. Whereas Germany and Switzerland show very steady and moderate growth over the observation period, the Anglo-Saxon countries exhibit about 30% higher GDP per capita growth rates (in local currency). At the same time their real estate movements are significantly more pronounced.

Excluding short-term bumps, real estate cycles seem to last for relatively short periods of 4-5 years, such as apparent for the US after the real estate crisis in 2008, up to longer periods of 15 and 30 years, such as observable in Switzerland and Germany respectively. It strikes that in these established markets real estate prices have outpaced the GDP growth rates in recent years with the exception of Germany. This is especially the case for the UK and the US. Although it is difficult to draw any conclusion as to whether real estate prices are high or not, we can state with certainty that real estate prices have somewhat outrun GDP growth in the last 20 years.

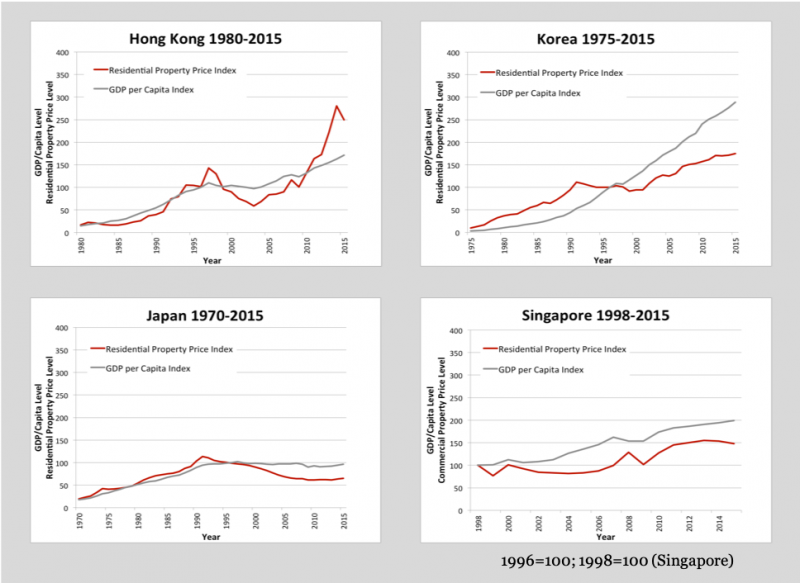

Figure 4 contains indices of developed Asian markets. Scaling was chosen to be equal as in figure 3, as it is the case for all of the following graphs. Similar as for the Western markets GDP and real estate returns display a high correlation over the observed period.

One can recognize the same typical mean-reversion of the real estate prices to the GPD as seen before. A good example for this phenomenon is Hong Kong, where the real estate prices appear to be basically just an amplification of the GDP per capita index. Even though real estate prices do not follow the GDP progression perfectly at all times, it is evident across all states that they revert to it systematically.

Figure 4: the case for developed Asian markets (GDP per capita vs. residential real estate prices)

The situation for emerging Asia

The overall outlook of the Asian property markets seems to exhibit a long-term fundamental growth trend that is catching up to developed world levels.This is especially true for emerging countries that exhibit ongoing high GDP growth rates, such as

China, Indonesia, Malaysia, Thailand, Philippines, India and Vietnam.

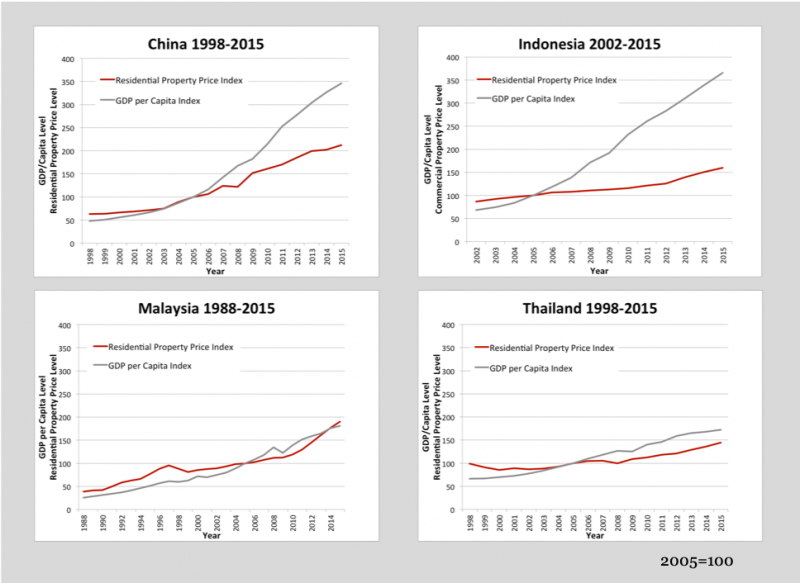

Figure 5 shows the development of the residential prices of the first four of these markets over the last 13 to 17 years, while only limited reliable data is available for the other three mentioned countries. Across all emerging Asian markets in figure 5 real estate prices have not (yet) caught up with their GDP growth rates, in contrast to the situation of their developed peers. This gap gives an indication of the currently still moderate development of emerging Asia's real estate price levels in comparison to the GDP per capita progression.

Again, from the short-run dynamics alone hardly any statement can be derived about whether prices are high or low; the graphs only reflect capital returns with no respect to market idiosyncrasies such as, for example, cap rates or structural peculiarities. Nonetheless, GDP outgrew real estate prices in countries that have been and are still rapidly developing, whereas in developed countries prices are reverting back to the long-term GDP trend.

Figure 5: the case for emerging Asia (GDP per capita vs. residential real estate prices

Similar picture for commercial property

Commercial real estate prices – similar to their residential counterparts – develop along with GDP growth. Generally speaking, the commercial sector is driven by investors on one hand and by corporate tenants on the other hand.

Tenants drive commercial real estate prices most directly. As an economy develops and the share of the industrial and service sectors grows, more and more commercial space is needed. Also, an increasing number of multinational companies enter the market and accordingly require office space in addition to the growing local businesses.

A larger and more established commercial real estate sector, in turn, draws more attention from global investors. They view the price of a property in the light of the achievable yield, the potential for capital appreciation, and potential portfolio diversification benefits alongside with factors such as market liquidity, regulations for foreign investors, and mortgage conditions.

Finally, the possibility – depending on local regulations – of a conversion from residential into commercial property and vice versa ties the price development of the two sectors further together. Be it from a homeowner, tenants, or investor perspective, GDP is arguably the main driver behind both residential and commercial real estate markets.

Figure 6 includes commercial real estate prices in comparison with GDP per capita and residential real estate prices for various Western and Asian markets. In all cases commercial and residential prices move in parallel, and in the case of strongly growing China GDP has again outpaced real estate price growth.

Figure 6: adding commercial real estate to the picture

Implications for Investors

The strong link between GDP growth and real estate price progression suggests that property investments in the metropolises of fast developing Asia are a very direct way to participate in economic growth. As a real asset value property also provides a natural hedge against inflation and currency moves. A longer-term currency depreciation normally evolves in conjunction with higher inflation, such that prices of traded goods stay internationally comparable at prevailing exchange rates. Higher inflation also translates into increasing real estate prices and rents, typically offsetting potential adverse currency moves. Moreover, and in contrast to global bond and stock markets, real estate is a much more local investment that offers true diversification benefits. This stems not only from the different GDP growth trends among countries, but also from short-term real estate cycles which overlap the long-term trend and are governed by various local supply and demand dynamics.

As the prospects for Asia's growth story remains promising, it is likely that the region remains the world's growth driver for the years to come. And as real estate is presumably the asset class that is most directly linked to economic growth, it appears to be prudent for global investors to take Asia as the world's growth engine into close consideration.

Sources

ADB; asean.org; Bloomberg; Bank for International Settlements; CB Richard Ellis; China Daily; CEIC; Centaline; Central National Banks; CitiBank; Colliers International; Credit Suisse Research; Cushman & Wakefield; Deloitte; Diener Syz Real Estate; DTZ Research; Economist Intelligence Unit; Financial Times; Focus Economics; Franklin Templeton; Frost and Sullivan; GaveKal Dragonomics; IMF; institute for building efficiency; Jakarta Post; Jones Lang LaSalle; Knight Frank Research; KPMG; LaSalle Investment Management; McKinsey Global Institute; Morgan Stanley Research; National, Provincial, and Municipal Bureaus of Statistics; Nomura Research; OECD; People's Bank of China; Political & Economic Risk Consultancy Ltd; PricewaterhouseCoopers; Reuters Real Estate; Savills; Shanghai Daily; Thomson Reuters; Trading Economics; UBS Research; UN; Wall Street Journal; WTO; World Bank; World Energy Outlook (IAE); Xinhuanet

Our complimentary publications inform you about current developments in the Asian real estate market and key trends in the real estate industry. Sign up to receive them automatically.