Building a greener Singapore, one office at a time

In today's climate-aware economy, the environmental footprint of buildings is no longer a background issue—it is central to the future of urban development. With nearly 39% of global energy-related carbon emissions attributed to the built environment, real estate plays a defining role in shaping sustainable cities.

Governments worldwide are responding with bold policy frameworks and financial incentives to green existing building stock—cutting emissions while preserving urban infrastructure. In Asia, Singapore has emerged as a leader. Its Green Building Masterplan targets 80% of buildings to be greened by 2030, demonstrating the city-state's commitment to climate action and innovation. This vision is powerfully aligned with Switzerland's own net-zero roadmap, and it resonates deeply with Swiss enterprises recognized for their environmental integrity and long-term thinking.

Bilateral frameworks—such as the Switzerland–Singapore Enhanced Partnership, which supports climate tech collaboration, and green finance cooperation between the Monetary Authority of Singapore and the Swiss Sustainable Finance Association—are creating fertile ground for sustainable growth. But beyond policy, the strongest momentum may be coming from the private sector.

More companies today are rethinking real estate—not just as a cost center, but as a strategic asset tied to ESG goals, employee well-being, and long-term returns. In Singapore, this shift is evident. Swiss firms including Julius Baer, UBS, and Swiss Re have all moved into certified green office spaces, demonstrating how environmental values and business efficiency can go hand in hand.

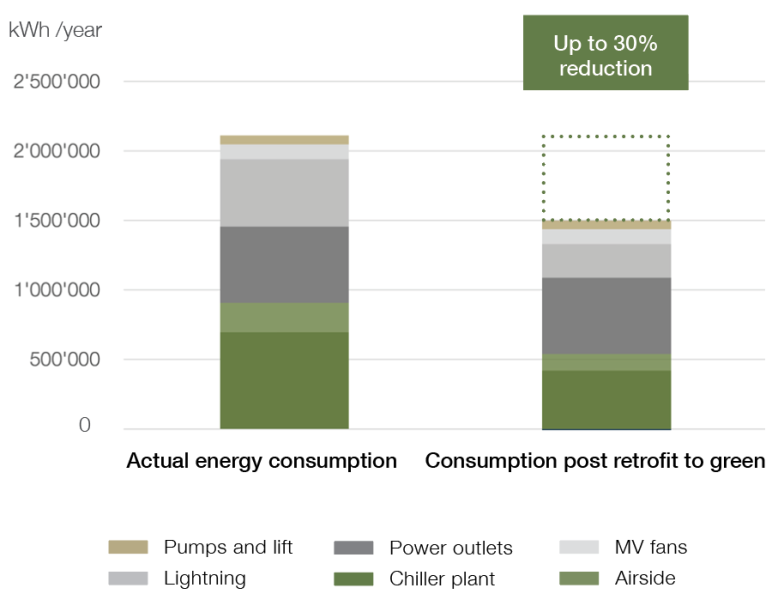

Green buildings are not only good for the planet—they are good for the business. Energy-efficient systems reduce utility bills, while natural lighting and improved ventilation boost employee productivity and reduce absenteeism. According to Singapore's Building and Construction Authority, green buildings can yield up to 25–30% in energy savings. Increasingly, investors reward ESG performance with better financing terms and higher valuations. For Swiss companies operating in Asia's most competitive city, this adds up to a strategic advantage.

While new builds often grab headlines, the most impactful sustainability gains are made by retrofitting existing buildings. This process, though complex, is gaining traction across Asia as cities like Hong Kong, Tokyo, and Singapore implement stricter environmental regulations and incentives.

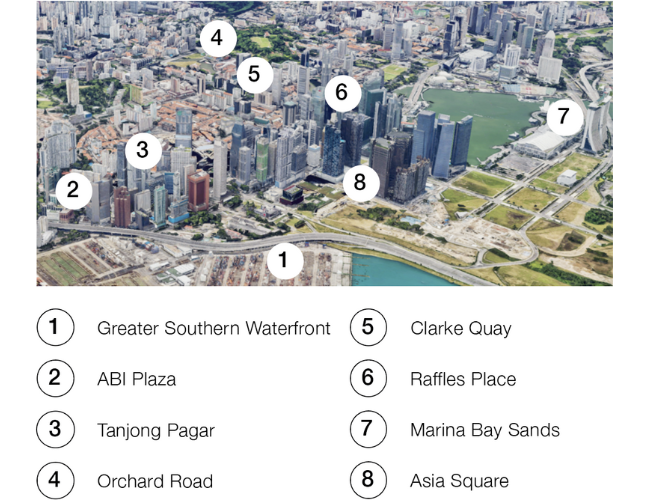

Amid this broader movement toward sustainable real estate, a compelling example of green retrofitting in action can be found at ABI Plaza, a commercial office building located in Singapore's CBD near Tanjong Pagar MRT station. Jointly owned and managed by Asia Green Real Estate—a FINMA-regulated Swiss asset manager specializing in sustainable real estate investments across Asia—and CapitaLand Investment, a global real asset manager headquartered and listed in Singapore, ABI Plaza is currently in the process of a full-scale energy retrofit.

The energy retrofit includes:

- High-efficiency cooling systems tailored to Singapore's tropical climate

- Smart building management systems for real-time energy optimization

- LED lighting with motion sensors to reduce electricity waste

- Rooftop solar panels to partially offset grid reliance

The transformation is expected to achieve up to 30% reduction in annual energy use—an estimated 650'000 kilowatt-hours per year, equivalent to the energy needs of over 230 Swiss households or more than 140 four-room Singapore HDB flats annually. ABI Plaza is on track to secure Green Mark Super Low Energy and EDGE Zero Carbon certifications, two globally respected benchmarks of environmental performance.

At ABI Plaza, sustainability meets city-center convenience. The property is surrounded by a vibrant mix of amenities, including restaurants, the 100AM shopping mall, and top-tier business hotels including M Hotel, Amara, and Oasia Downtown. Beyond day-to-day convenience, the property's location offers a powerful strategic advantage. ABI Plaza sits within the ambit of the Greater Southern Waterfront (GSW) redevelopment area—a visionary, long-term government initiative to transform Singapore's southern coastline into a thriving hub for work, life, and leisure. Spanning over 2'000 hectares and six times the size of Marina Bay, the GSW is envisioned as Singapore's next downtown.

With the upcoming Circle Line MRT stations—Prince Edward and Cantonment—within a five-minute walk and a wealth of new amenities on the horizon, ABI Plaza is set to thrive at the intersection of heritage and future. Its positioning between the traditional CBD and this emerging precinct makes it especially attractive to businesses seeking strategic alignment with Singapore's future growth corridors.

While the full potential of the GSW will unfold over time, ABI Plaza is already delivering value today. Tenants have tangible improvements in operational efficiency and workplace comfort—proving that sustainability and strategic location are not mutually exclusive. As one tenant stated, moving into ABI Plaza allowed them to "align operational space with corporate sustainability goals without compromising on quality."

For companies considering long-term presence in Singapore, the economic case is reinforced by government support. Incentives like the Enterprise Development Grant cover up to 70% of costs for green initiatives, while the Refundable Investment Credit offers tax credits for decarbonization investments. These schemes significantly strengthen the ROI of going green.

Choosing a green building in Singapore is more than a local real estate decision—it is a strategic ESG investment. It affirms a company's commitment to global climate goals, including the net-zero by 2050 pledge. In addition, it enhances corporate reputation, attracts talent, and aligns with rising demands from shareholders, clients, and regulators.

In this context, ABI Plaza becomes more than a building. It represents the convergence of profitability, innovation, and environmental responsibility. It shows how Swiss values—precision, foresight, and excellence—can thrive in one of Asia's most forward-looking cities.

As the built environment transforms to meet climate challenges, the opportunity is clear: invest in places that future-proof your business and the planet. Now is the time to lead the change—one building at a time.

Sources

Asia Green Real Estate; World Green Building Council; Eidgenössische Departement für auswärtige Angelegenheiten (EDA); Building and Construction Authority Singapore

我们的免费刊物将向您介绍亚洲房地产市场的最新发展情况和房地产行业的主要趋势。欢迎注册,以便即时接受相关资讯。