What the trade dispute means for China’s economy and real estate

Global trade disputes are nothing new, as can be seen in the below figure that shows complaints lodged with the WTO since its formation 23 years ago, in 1995. Historically, most disputes were able to be resolved within 15 months, and the party lodging the complaint usually wins.

However, the United States recently decided to adopt a vastly different approach in an attempt to resolve the trade imbalances and disputes by imposing additional tariffs on some of its trading partners including the European Union, Canada, Mexico, and China. The head of the National Foreign Trade Council and a former negotiator, Rufus Yerxa, likened that to “throwing out the rule book on trade.” He said, “I’ve been dealing with this stuff for four decades and I’ve never seen anything like this.”

Not surprisingly, this move by America has been met with immediate countermeasures from its trading partners. And these tit-for-tat increases between the United States and the other countries essentially marked the start of a trade war. Although the scale of the trade war is still currently relatively small, it has been met with criticisms from governments and businesses all over the world, including US businesses and farmers.

In this ASIA INSIGHTS, we will take a look at how the trade war came about, and what that means for China’s economy and its real estate market.

How the trade war started

It is widely believed that the underlying cause of the global trade imbalance is due to a surplus in steel worldwide. The global steel production capacity is about 700 million tons more than what customers reportedly require – the excess capacity is equivalent to 7 times the total US production, according to the US Commerce Department.

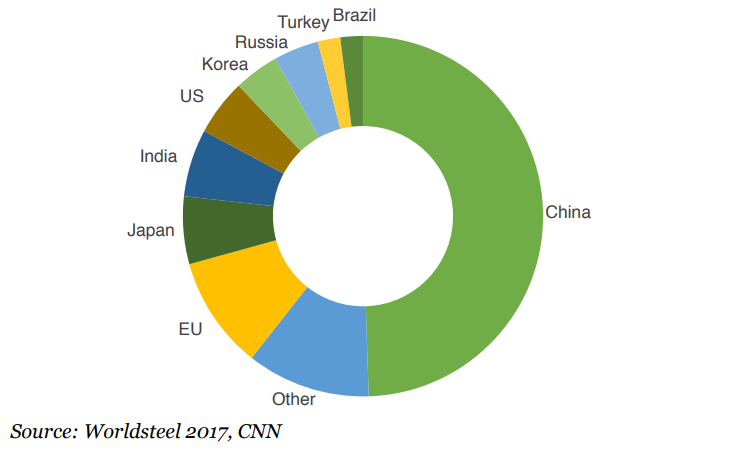

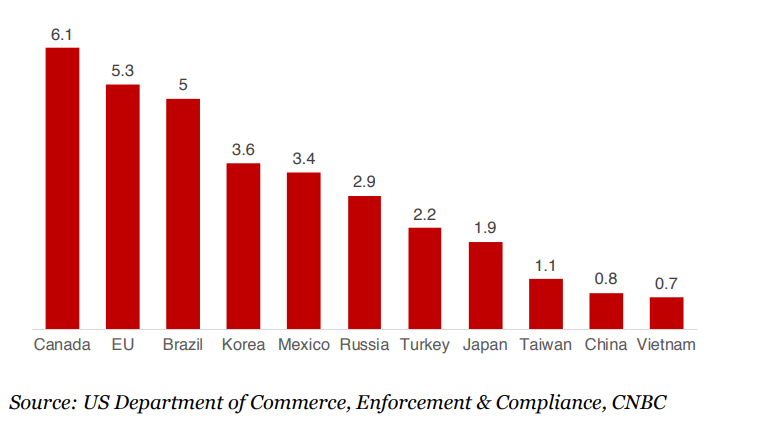

Consequently, the steel surplus has led to lower prices worldwide, making it difficult for US steelmakers to effectively compete globally with steelmakers from other countries. China, being the largest steel producer in the world, has been blamed for the depressed prices, even though it is, by far, not the largest steel exporter to the US. China steel export to the US was previously already subject to trade restrictions, unlike some other places, such as the EU.

It may have started with steel, but trade discussions have obviously grown to a much broader scale, as US President Trump has long believed that the country’s trading partners have been constantly taking advantage of the United States. He said in a written statement that “the United States has been taken advantage of for many decades on trade”. Progress on trade talks with the EU, Canada, Mexico and China were also deemed slow by the US President. As such, America announced a 25% tariff on imported steel, and a 10% tariff on imported aluminum against the EU, Canada, and Mexico on May 31 2018.

Its trading partners responded in kind. Canada slapped surtaxes on USD12.8 billion of American products, ranging from steel to food products. The EU revealed a 10-page list of US products that have been identified as potential targets for additional tariffs, and Mexico plans to impose pork tariffs. While trade discussions among the nations are ongoing, the US has moved ahead with tariffs against Chinese imported goods.

Trade between the US and China

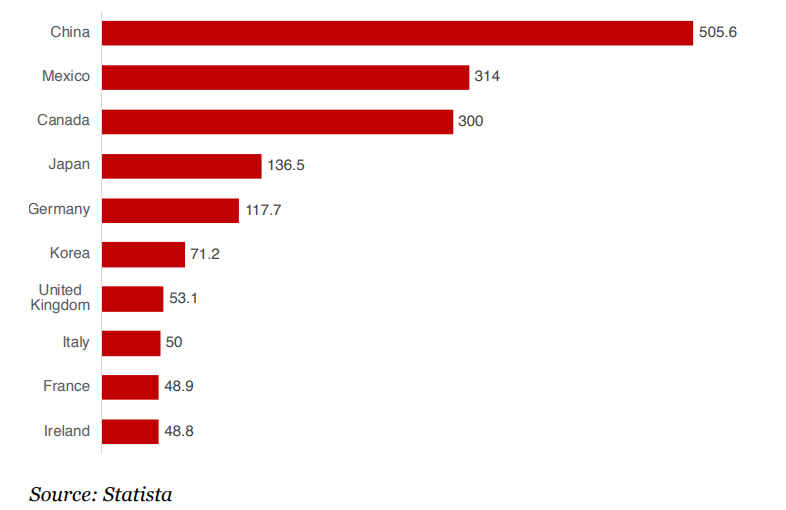

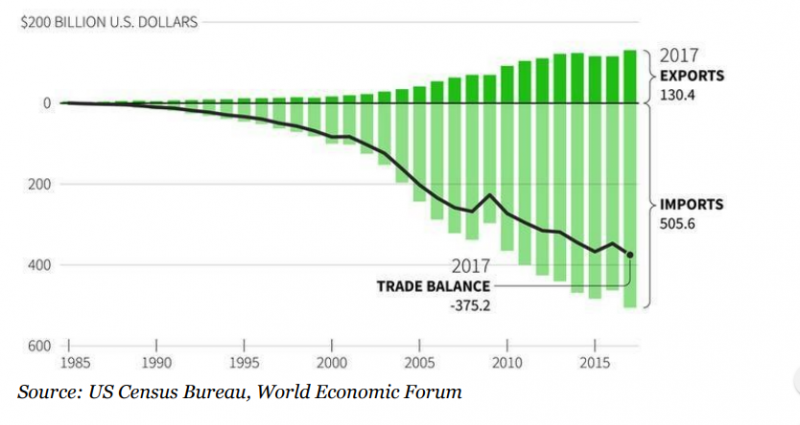

A lot of rhetoric by the US on trade has been about China. This is hardly surprising, as America’s current largest importer is China, with an approximate 2017 import value of USD 500 billion, followed by Mexico in a distant second at about USD 300 billion

What prompted discussions and action from the US against China imports is the growing trade deficit between the two countries. Of the USD 375 billion of trade imbalance in 2017, almost half of it is attributed to the computers and electronics industry, in which China is a powerhouse manufacturer.

Consequently, at 12:01am on July 6 2018, the United States levied an additional 25% tariff on more than 800 Chinese import products (e.g. computer hard drives, LEDs, machinery, etc.) valued at USD 34 billion. In a swift response, the Chinese government imposed retaliatory tariffs on USD 34 billion worth of US goods, such as soybean, seafood, pork, and automobiles.

The US has subsequently threatened China with up to USD 200 billion of imported goods. However, the Chinese Commerce Ministry has stated that, “China doesn’t hope to be in a trade war, but is not afraid of engaging in one”, and it has continued to be of this view. In addition, China maintains that its “door of dialogue and negotiation remains open, but any dialogue must be based on equality, mutual respect, and rules”. It has also lodged a complaint against the US to the World Trade Organization.

It is important to note that a major reason for the deficit is because many US (and other countries) manufacturers send raw materials to China for assembly. However, once the semi-finished or finished products are shipped back to the US, they are considered to be imports.

In addition, China’s Foreign Minister Wang Yi has stated that 60% of the China’s trade surplus with the US is because of foreign companies operating in China. This is consistent with a 2011 study by the San Francisco Reserve Bank, which stated that for every dollar spent on a China made item, 55 cents went towards services produced in the US. This implies that majority of the parties being affected would actually be non-Chinese entities.

Implications to the Chinese economy

Whilst a trade war does not really benefit any party involved, the direct impact to China could potentially be controlled. China has increasingly become less reliant on exports over the years. To put things in perspective, exports account for 36% of China’s GDP in 2006, but it currently only represents 23% of the country’s GDP. Furthermore, even if the US imposes tariffs on USD 200 billion worth of Chinese goods, it would only account for about 7% of China’s total exports in 2017, and represents only 1.6% share of China’s 2017 total GDP. China’s overall GDP growth is still strong, experiencing a growth rate of 6.9% in 2017. Its 2018 Q1 growth rate was 6.8%. So, even if that were to decrease marginally, it still represents an extremely strong growth rate for the second largest economy in the world.

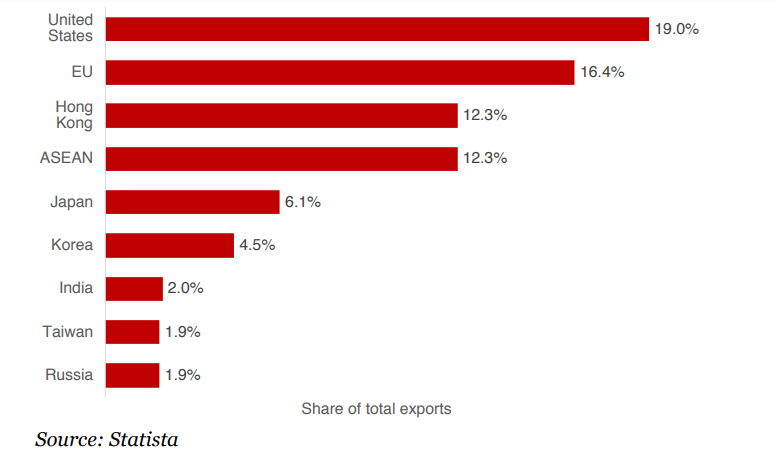

Furthermore, China and the rest of the world are not standing still, but are proactively addressing the trade issue though bilateral and multilateral trade negotiations and partnerships. In 2017, the US accounted for almost 20% of China’s total exports, followed by the EU with an export value of about USD 440 billion. One-fifth is undoubtedly a significant portion of China’s total trade, but this also represents an opportunity for other countries to increase trade relations with China. To this extent, countries all over the world have recently already started to change the way they trade and do business.

For example, negotiations on Regional Comprehensive Economic Partnership (RCEP), a free trade agreement among 10 ASEAN member states (includes China, Australia, India, Japan, and Republic of Korea) have accelerated. All parties involved have agreed that it would be everyone’s benefit to conclude negotiations as soon as possible.

BRICS (Brazil, Russia, India, China, South Africa) has also pledged unity and increased trade cooperation. Along this line, India has also mentioned the US trade tariffs on Chinese goods is a “golden opportunity” for them to export soybeans to China. Brazil has also stated that they are able to ramp up soybean production and distribution to China very quickly.

In addition, Japan and the EU recently signed a deal that would significantly reduce tariffs. The deal, which was the largest to have been struck by the EU, would essentially create a trade zone that would cover 600 million people and almost 1/3 of the global GDP. All these trade changes will take time to be implemented. However, it is clear that global trade will evolve, and new bilateral and multilateral partnerships will continue to be forged. The direct impact to the Chinese economy would most likely be seen in higher prices for certain imported products and manufacturing.

However, short of a worldwide recession, economists do not expect the Chinese economy to be severely affected. Factories, especially those in the lower-end of the value chain, would likely be affected by the trade dispute. But companies have already been moving lower-end manufacturing, albeit at a slower pace, from China to other countries, such as Vietnam and Thailand, for many years. The trade dispute would just accelerate the migration process, which is consistent with China’s policy to move the country’s manufacturing up the value chain, and to phase out outdated capacity.

China’s growing domestic demand economy

There is much that China can do to help offset the impact from the trade dispute. One area of focus for the Chinese government is the steady growth of the country’s domestic demand, which is considered by many to be the backbone of China’s economic development.

Over the years, China’s economic structure has been steadily shifting from one that depends on exports to one that focuses more on expanding domestic demand, which is in line with what economists have been recommending. Between 2013 and 2017, the country’s domestic demand grew from 50.3% to 53.6% of total GDP. Domestic demand’s contribution to GDP increase has also increased from 51.0% to 58.8% over the same period. China will continue to implement fiscal and monetary policy in support of this.

Implications to the Chinese real estate market

With a strong and resilient economy, the direct implications of the trade dispute to the Chinese real estate market are expected to be small. To date, the Chinese property sector has been largely unaffected, and demand for real estate continues to be strong, even in light of the trade dispute.

Housing

Housing demand remains very strong for both first time homebuyers and upgraders. Austerity measures, such as price restrictions or limiting the number of residential property that one can purchase, continue to be in place in first tier cities, such as Shanghai and Beijing. However, similar austerity measures have been recently implemented in cities across the country because of strong demand. Culturally, Chinese like to own real estate and if weren’t for the austerity measures, the demand, and in turn the transacted volume and price, would be even higher.

Residential transacted volume in China grew an astounding 28% from about 1.2 to 1.5 billion square meters between 2015 and 2017, with a price increase of about 18% over the same period. Both the 2018 residential transacted volume and price are expected to increase, even in light of the trade dispute. Developers continue to be optimistic about the sustainability of the country’s housing demand.

Office

Office leasing is expected to continue to be strong. According to real estate consultant Cushman & Wakefield, China absorbed almost 6.0 million square meters of office in 2017, representing an increase of more than 50% in 2016, due in a large part to technology and multimedia companies. Trading companies represent only a small portion of the total leasing volume. The net absorption is expected to increase to more than 6.3 million square meters in 2018.

There may be short-term fluctuations, as some foreign companies might wait for more clarity on the trade dispute before making a commercial leasing decision. However, office absorption is expected to remain strong because most of the demand is coming from domestic firms, not foreign companies. In addition, over the mid to long-term, foreign companies will still choose to be in China because of its large and growing economic base, thus helping to drive office leasing demand.

For example, the People’s Bank of China (PBOC) still has a lot of room to adjust the banks’ Reserve Requirement Ratios (RRR). After a 50 basis point cut on July 5, the RRR is currently 15.5% for large banks, and 13.5% for small banks in China. This cut essentially released about USD 108 billion of liquidity to the market, which will provide credit support to companies and individuals. This would also allow the Chinese local governments to increase spending on urban redevelopment projects and infrastructure investments. In addition, China recently cut commercial and industrial electricity prices by about 7%. Further cuts are expected, as necessary. They have also stated plans to reduce taxes for individuals and companies. All of these measures are in line with the country’s effort to reduce corporate and individual costs, which will ultimately put more money in people’s hands, thus helping to spur domestic demand.

While it may not be possible for China to completely eliminate the impact from the trade dispute, a strong domestic demand economy will afford the country the ability to mitigate its effect. What has been discussed in this article is just a small sample of what China is doing on this front, but it is clear that the Chinese government is fine-tuning its fiscal policies, and actively working towards bolstering its real economy and increasing domestic demand. At the end of the day, a sound economy will lead to the continued healthy development of the country’s real estate market. Implications for investors Whilst it is impossible to know how long the trade dispute will last, it is clear that China, along with the rest of the world, is adapting and transforming the way trade is conducted. In the mean time, short-term fluctuations can be expected, but that does not materially change the health of China’s overall economy and its real estate sector.

As such, investors should not be taken in by too much noise on the trade dispute, but instead focus more on the mid to long-term prospects of China’s economic development. To that extent, the trend for China’s real estate sector is still on the rise, and investment opportunities exist in many key urban areas across China.

Sources

ADB; asean.org; Bloomberg; CB Richard Ellis; China Daily; CEIC; Centaline; CitiBank; CNBC; CNN; Colliers International; Credit Suisse Research; Cushman & Wakefield; Deloitte; Diener Syz Real Estate; DTZ Research; Economist Intelligence Unit; Financial Times; Franklin Templeton; Frost and Sullivan; GaveKal Dragonomics; IMF; institute for building efficiency; Jakarta Post; Jones Lang LaSalle; Knight Frank Research; KPMG; LaSalle Investment Management; McKinsey Global Institute; Morgan Stanley Research; National, Provincial, and Municipal Bureaus of Statistics; Nomura Research; OECD; People’s Bank of China; Political & Economic Risk Consultancy Ltd; PricewaterhouseCoopers; Reuters Real Estate; Savills; Seeking Alpha; Shanghai Daily; Statistica; Thomson Reuters; Trading Economics; UBS Research; UN; US Census Bureau; US Department of Commerce; Wall Street Journal; Washington Post; WTO; World Bank; World Economic Forum; World Energy Outlook (IAE); World Steel; Xinhuanet

Our complimentary publications inform you about current developments in the Asian real estate market and key trends in the real estate industry. Sign up to receive them automatically.