Co-working and co-living – the sharing economy arrives in Asia’s metropolises

As a younger generation enters the workforce in Asia’s metropolises, various concepts catering for a trendy lifestyle, and at the same time increasing urban density, are emerging in the real estate sector. This phenomenon is further driven and supported by a long-term urbanization trend in Asia. One of the main reasons to live and work in a city is for the convenience and opportunity to interact with other people. Despite numerous predictions that centralized workspaces can be replaced with the arrival of the Internet, that has not materialized and workspaces in cities have grown stronger than ever before. Many of the world’s most valuable firms are no longer concentrated in a few metropolises such as New York and Tokyo, but are nowadays often headquartered in smaller cities such as Cupertino, Palo Alto, and Seattle. But still, the urban creative and social interaction is more important than ever before (and more so physical rather than online). The modern city is a knowledge hub, driven by the interaction and exchange of information that generates new ideas that would not have emerged if one were working alone at home. The co-working approach has been popular in the US for a while, with creative office space provider WeWork at the forefront of the trend. The company started seven years ago. It enters into long-term leases with landlords, and offers working space in their simple and modern fitted-out offices at a markup. The concept emphasizes creating an office space or working environment that supports collaboration, openness, knowledge sharing, innovation, and user experience. In the last two years, a boom for co-working spaces was triggered in Asia, with new office space providers appearing every few months. On the residential side, co-living concepts have been developed more recently in high rent cities to address the need for affordable housing for young people. Community driven shared spaces to cook together, eat together, and launder together are key features of co-living spaces, again to increase density and facilitate social interaction. In this Asia Insights, we look at the new concepts of how the younger generation in Asia’s cities live and work in a socially interactive and affordable way.

Further, utilizing co-working space allows multinationals to unlock flexibility needed to scale up or down relatively quickly. Mostly, it is the multinationals’ technology and innovation teams that move into these spaces. In the medium term, other departments could also start moving to this type of workspace, thus allowing for more scaling options by combining core space and flexible space. With multinationals entering the market, the average workspace transaction size has increased significantly globally. Transactions involving 15 desks or more have almost tripled, now comprising 35% of deals, compared to only 12% two years ago. The number of co-working tenants worldwide is expected to reach 3.8 million in 2020. As recently as 2015, there were only a few independent co-working sites in China. In 2016, however, numerous co-working operators have opened office spaces in many of the country’s Tier 1 and larger Tier 2 cities. Co-working is currently growing exponentially in China — there are now more than 500 co-working sites in Shanghai and Beijing alone. URWork, a Chinese co-working brand established in April 2015 by a former executive of real estate firm China Vanke, opened 11 spaces and signed more than 30 leases across 15 cities within only one year. A year later, the same entrepreneur also founded 5Lmeet, which offers round-the-clock lifestyle amenities in addition to the more conventional co-working space. WeWork entered China in September 2016, when it secured three locations in Shanghai, with plans to expand to other cities quickly. Further, players including Naked Hub and Distrii from Shanghai, or Beijing’s SOHO 3Q co-working chain (also known as the “Uber for Offices”), are all trying to capture market share as quickly as possible. Similar to Shanghai and Beijing, co-working spaces are booming in other Asian metropolises such as Singapore, Hong Kong, Seoul, Hanoi, and Ho Chi Minh City.

Higher revenue per square meter, but cheaper than traditional office space for tenants

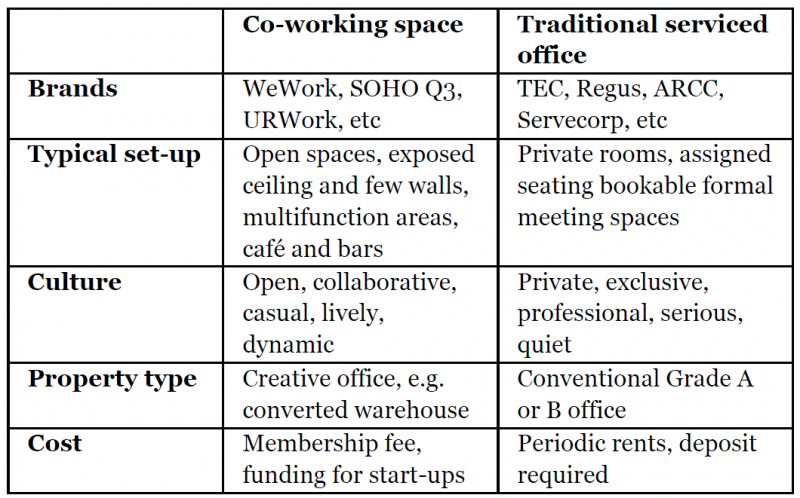

Although the cost per workspace is normally less than traditional offices, most providers are still targeting the higher end of the market As the typical co-working open office layout does not require any doors, they usually require fewer square meters per person. The cost for a workspace is hence less than in traditional offices, while the revenue per square meter is higher. The goal of this concept is to make a workstation affordable for individuals, while still targeting upper market segments that seek central locations with easy transportation access. The traditional rental concept has also been thrown overboard. Rather than tenants renting office space for a longer period of time, the co-working “members” can get access to “hot desks”, “fixed desks” or larger office spaces for entire teams on a monthly or short-term basis.

Factors driving Asia’s co-working boom

- Rise of the millennial workforce

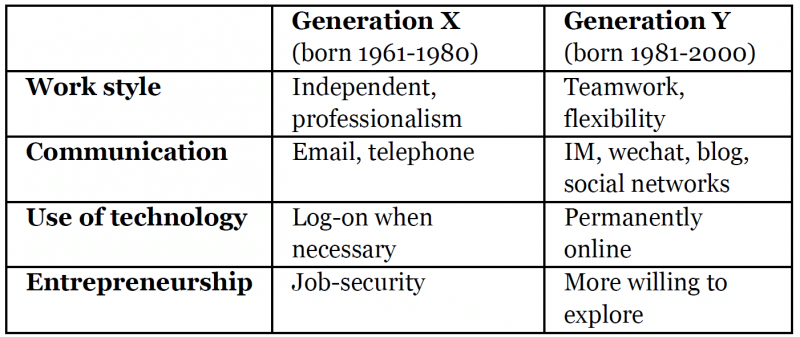

More and more companies in Asia are recognizing the rising importance of the millennial generation, who are increasingly shaping the workplace. While older generations valued having a cubicle and prioritized job security, young workers today pursue different priorities, such as work/life balance and flexible working hours. - Shift towards sharing economy

Ride-sharing app Didi Chuxing (similar to Uber) and home-sharing website Xiaozhu.com (similar to Airbnb) are just two examples of online sharing services that have become essential for young people in China. The fundamental concept of co-working aligns with the general shift toward the sharing economy. - Technology boom

Advanced technology underlies many of coworking spaces’ unique offerings, such as convenient online booking and the building of online communities for members. A good example is the popular social networking app WeChat, which has a 93% penetration rate in China’s Tier 1 cities and is well-known as a pioneer in a range of mobile services, from instant messaging to online payments. - Government support

In China, the central government has made clear its support for start-ups. At the 2015 World Economic Forum in Davos, Chinese Premier Li Keqiang proposed “mass entrepreneurship and innovation” for China, signaling an official encouragement for startups, which are co-working spaces’ target tenants. The number of newly registered companies in China reached more than 4 million in 2015, up 21% from the year before.

In Shanghai, a desk in an open office space costs typically between RMB 2’000 to RMB 3’000 (USD 300 to USD 450), making co-working more affordable and flexible than other office options. In Hong Kong, a desk costs around HKD 7’000 (USD 920), about 10% less than a one-person private office. Further, member benefits of the co-working concept include scalability, no long-term contracts, no initial capital expenditure for fit-out, and no deposits. For co-working members that are start up companies, operators often also offer networking opportunities, online platforms to exchange services, and even access to business angels and experienced mentors. In some countries, governments run startup programs that offer three to 12 months of sponsored space as well as support from government offices, mentorship and the chance to participate in startup competitions and other events. Of course, the short rental periods and the flexibility have a flip side as well. Since operators rent longterm leases from the landlord, they risk being stuck in a costly situation if demand were to sharply decrease. In this light, it remains to be seen if co-working and co-living operators are experiencing an overly optimistic hype. For example, WeWork has now a valuation of roughly USD 20 billion, in comparison to traditional office space provider Regus (now renamed IWG) worth about USD 3 billion. As the flexible workspace market grows, traditional serviced office operators are reviewing their strategies to ensure continued growth. In an effort to adapt to new concept of shared office space, IWG recently acquired a co-working operator, which they are now rolling out globally.

Co-living targeted at millennials

The residential and hospitality industry is competing to find ways to appeal to modern millennials (the socalled Generation Y born between 1981 and 2000), a group that will make up half of the planet’s workforce by 2020 and spends around USD 200 billion on travel each year. Figure 2 illustrates the different work and communication styles of Generation Y compared to the older Generation X. An increasing number of shared living spaces has been developed in the US and globally. WeWork launched its own WeLive brand in April 2016, betting that – as with shared offices – customers would pay a premium over the cost of sharing an apartment with friends to gain more flexible leases and housekeeping, along with amenities such as shared gyms and lounges.

In Singapore, serviced apartment provider Ascott has partnered with Singapore Management University to open a 3’000 square meter residential laboratory in the historic Malaya Publishing House to explore new habitats for Generation Y. Ascott sees Singapore as an ideal ground to test innovative hospitality concepts, designed and targeted at Asian millennials. Ascott has set up the lab to field test its lyf brand (pronounced “life”), which it opened in November 2016 to target the growing spending power of younger residents. The lab incorporates social areas, study rooms and concept living quarters, and combines these with activities such as startup workshops, hackathons and innovation talks. Also, other players have been quick to catch onto the co-living wave, with Deson Development and 5Lmeet starting a shared accommodation projects in China, as well as Campus HK, which opened the first coliving student housing project in Hong Kong.

Implications for investors

Unlike the retail sector that has been shaken up by online shopping, office and residential real estate is unlikely to be fundamentally disrupted by digitalization or the sharing economy. Rather, new concepts and technology will complement or replace older ones to accommodate the demand that results from a younger generation’s lifestyle. For commercial landlords, the growing popularity of flexible workspace can have both positive and negative impacts. WeWork has already become the biggest tenant in New York, and flexible workspace operators can be expected to take up large amounts of office space in Asia’s metropolises as well. Also, flexible workspace operators can generate traditional tenant agreements for the landlord, if its clients or members switch to renting a longer-term traditional office space.

One of the negatives of flexible workspace operators is the landlord’s loss of control over the tenant mix. A building owner hence needs to be careful in selecting the right flexible workspace operator that best complements its existing tenants. In any case, office developers should more than ever adhere to the rule that a flexible layout is valuable (i.e. maintaining the option to have an open space or traditional offices), and potentially reconsider their standard handover conditions. Finally, as young people place more emphasis on health and the environment, sustainability components such as air filtration, gyms, indoor climate, and energy efficiency will become increasingly important and valuable in the market.

Sources

ADB; asean.org; Bloomberg; CB Richard Ellis; China Daily; CEIC; Centaline; CitiBank; Colliers International; Credit Suisse Research; Cushman & Wakefield; Deloitte; Diener Syz Real Estate; DTZ Research; Economist Intelligence Unit; Financial Times; Franklin Templeton; Frost and Sullivan; GaveKal Dragonomics; IMF; institute for building efficiency; Jakarta Post; JLL Research; Jones Lang LaSalle; Knight Frank Research; KPMG; LaSalle Investment Management; McKinsey Global Institute; Morgan Stanley Research; National, Provincial, and Municipal Bureaus of Statistics; Nomura Research; OECD; People’s Bank of China; Political & Economic Risk Consultancy Ltd; PricewaterhouseCoopers; Reuters Real Estate; Savills; Shanghai Daily; Thomson Reuters; Trading Economics; UBS Research; UN; Wall Street Journal; WTO; World Bank; World Energy Outlook (IAE); Xinhuanet

Our complimentary publications inform you about current developments in the Asian real estate market and key trends in the real estate industry. Sign up to receive them automatically.