The Belt-and-Road initiative and the rising importance of China’s Western cities

China’s East Coast became wealthy over the past decades thanks to its access to the sea and hence to global trade. Today, the Belt-and-Road initiative starts to link China’s inland cities to the intercontinental trading routes. The augmented revival of the Silk Road raises the strategic importance of those cities and further enhances their strong economic growth.

China’s East Coast became wealthy over the past decades thanks to its access to the sea and hence to global trade. Today, the Belt and Road (BR) initiative starts to link inland cities to the intercontinental trading routes. The augmented revival of the Silk Road raises the strategic importance of Chinas Western cities and further enhances their strong economic growth.

The BR Forum held over two days in Beijing in May 2017 was attended by China’s President Xi Jinping, as well as by many other world leaders and international organizations, such as the UN, the World Bank, and the IMF. More than 270 cooperation agreements were signed during the forum, reaffirming the international community’s commitment and desire to push forward with the development plan. For example, Jim Yong Kim, President of the World Bank, stated that participants showed great interest in the initiative and were already discussing the means of how to work out detailed plans only hours after the forum started.

During the forum, China pledged an additional contribution of USD 15 billion to the Silk Road Fund, aimed at the development of cities and countries along the BR initiative. This is on top of the USD 60 billion that China has already invested in the fund. Moreover, China’s President Xi pledged USD 57 billion in loans, and another USD 9 billion as aid for the involved developing countries. This funding boost provides a major signal in favor of the BR initiative, which has since been getting more and more international support. Currently, there are already 68 countries and international organizations involved.

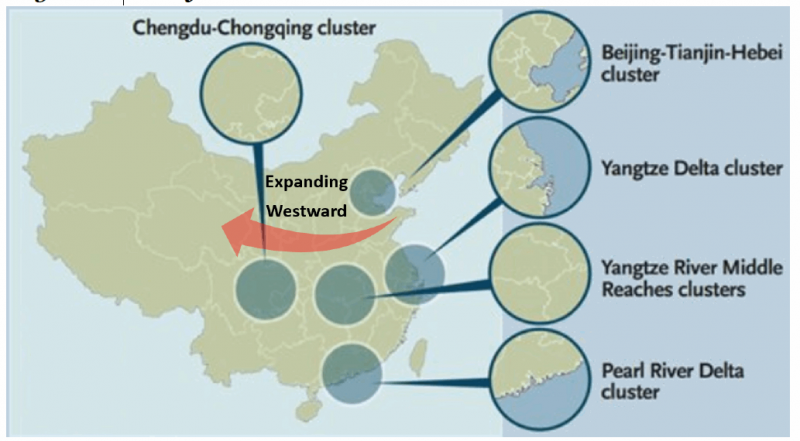

As the BR route cuts across China all the way to Central Asia and then to Europe, many of the cities located in the West of the country are poised to directly benefit from the initiative.

Major economic clusters are now emerging westward from China’s traditional trade areas at the coast. For example, Chengdu, the capital of Sichuan province, was historically the starting point of the ancient Southern Silk Road trading route. Today, the city cluster Chengdu-Chongqing is well positioned to become a gateway between the economic centers along the coastal area and other inland Chinese cities, as well as other countries.

In this ASIA INSIGHTS, we will take a look at the BR initiative and its implications for real estate investment opportunities in West China.

What is the Belt and Road initiative?

The BR initiative is arguably one of the most significant global economic development plans in history. The coverage area of the initiative is immense – it involves 68 countries equaling two-thirds of the word’s population, one-third of the world’s GDP, and the logistics of one quarter of the world’s goods and services. Most of the Eurasian continent as well as Eastern Africa is included in the initiative.

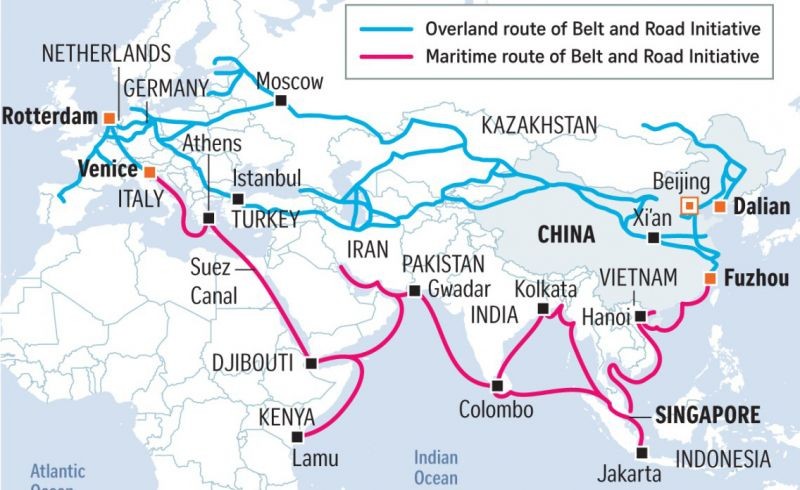

President Xi initially introduced the concept in 2013, expanding on the idea of the ancient Silk Road trade routes to strengthen the region’s infrastructure and economy. Today, the BR initiative has expanded and consists of two major parts of modern trading routes – the Silk Road Economic Belt and the Maritime Silk Road stretching across multiple countries and regions.

When initially introduced, the BR plan was perceived as a Chinese initiative. At that time, the vice-director of China’s State Council’s Development Research Center (Zhang Junkuo) said "the Silk Road idea is aimed at broadening the channels for China's westward development, while it may also create new opportunities for accelerating economic transformation in the country." However, over the years, the initiative has clearly evolved into a collective international effort to broaden growth and foster globalization. Whilst all participating countries will benefit from the BR initiative, China is expected to relatively gain the most in terms of economic and political influence as a result.

Rise of China’s Western region

China’s economic growth has continued to be strong, and is expected to achieve 6.7% in 2017, 0.2% higher than the original target of 6.5%. This puts China well on track to reach its goal of doubling the country’s real GDP between 2010 and 2020.

However, there remain regional differences in terms of the speed of economic development throughout the country. For example, Chongqing, a municipality located in Southwest China, experienced the highest regional GDP growth rate in the country with 10.5% in the first half of 2017. Guizhou province, also located in Western China, came in second with a GDP growth rate of 10.4% in the first half of the year.

Western China is starting from a lower economic base than the East, but its economy is gaining momentum rapidly. Chongqing and its surrounding provinces (e.g. Sichuan, Guizhou, Shaanxi, and Hubei) are strategically well situated along the planned routes for the BR initiative. As such, the capitals in those provinces are especially poised to benefit from the westwards push as they attract the largest companies and most talented employees in the region. Consequently, more and more people are now choosing not to relocate to the coastal economic centers but to stay in their home provinces and to move to their capitals. Additionally, Western provincial capitals have been getting larger proportions of each province’s investment and resource budget to improve their infrastructure.

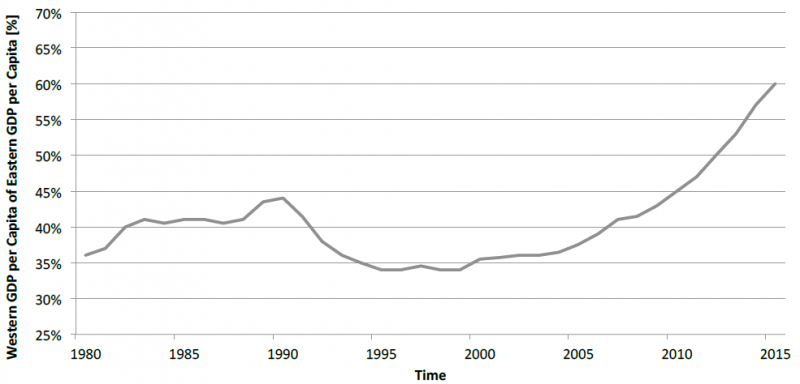

As the above chart illustrates, GDP per capita in Chinese cities in the West has been lagging that of the coastal cities in the past. It has started to increase steadily since the early 2000s, largely due to China’s Go-West strategy, which was launched in 2000 to boost economic development there. Between 2000 and 2016, China has invested USD 950 billion in 300 major infrastructure and energy projects in the Western region. Part of the BR Initiative, which piggybacks on China’s Go-West strategy, has also undoubtedly contributed to the rise in recent years, as evidenced by the rapid growth in GDP per capita after 2012 - and the trend is expected to continue.

Impact on the real estate industry in China’s Western region

The impact of China’s Go-West strategy and the BR initiative on the real estate industry has become impossible to ignore. Unsurprisingly, the investment class to be impacted first was the infrastructure sector. After the BR initiative was announced, numerous international investors became partners in the Infrastructure Financing Facilitation Office (IFFO), which is responsible for the BR initiative’s infrastructure projects.

Alongside the improvement of the infrastructure and the economy of Western Chinese cities, demand for commercial and residential properties has been increasing. More and more businesses and young talents are drawn to the provincial capitals due to an increase in business activity between those cities and China’s coastal cities, as well as other countries participating in the BR initiative. Consequently, there has been an increased presence of leading real estate companies in the Western region building commercial and residential projects to accommodate the demand. For example, Vanke (a top 10 real estate company in China), Landsea (a Chinese top green and sustainable developer) and CapitaLand (one of the largest real estate companies in Asia) all have a significant presence in the region. Generally, the Chinese central government sets the overall economic policy for the country and leaves the details of the planning and execution to the provincial and local governments. Currently, the BR initiative and the Go-West policy are among the top priorities for China. As such, it is undeniable that the Western cities’ rapid development and transformation in recent years is to a large extent due to a push from both Beijing and the provinces. As economic interaction between China’s Western cities and other BR nations increase, demand for commercial and residential spaces will continue to increase there accordingly. While first-tier cities such as Shanghai and Beijing are entering into a maturity stage, key cities in Western China such Chengdu, Chongqing, Wuhan, and Guiyang are still very much in a growth phase for the next few years. As illustrated by the example of Chengdu in the text box, key cities in Western China have been experiencing higher real estate prices increases due to the strong demand, especially in core areas of the cities. The economies of these cities are now growing faster compared to the coastal areas. Also, real estate prices are starting off from a significantly lower base, which in turn offers a foreseeable upside potential along with the on-going growth of these cities.

Implications for investors

As China’s economy expands further, first-tier cities such as Shanghai and Beijing will undoubtedly continue to attract large investments. Real estate investors can expect to see stable and consistent returns over the mid- to long-term in these cities. Nonetheless, these cities are the most mature within China and asset prices as well as rental growth rates will likely moderate compared to previous years.

How Chengdu has transformed due to the BR initiative and the Go-West policy

Chengdu is the capital of Sichuan province, and an important economic gateway in Southwest China in the context of the BR initiative. In 2016, Chengdu achieved a GDP of USD 182 billion, ranking #9 of all Chinese cities. Chengdu’s 2016 GDP growth rate was 7.7%, about 1% higher than the national average of 6.7%. The city has an urban population of 8.7 million, and has been experiencing an average annual population growth of 1% over the last few years, thus showing that more people are consistently drawn to the city. Some milestones of the BR initiative and China’s Go-West policy that were realized in Chengdu include:

- Free Trade Zone – Established in 2017 to promote international trade between the Sichuan province and other countries

- Second international airport – Started construction in 2017. Upon completion in 2020, Chengdu will be the only city with two international airports besides Shanghai and Beijing

- China-Europe cargo train – First city in China to operate on the China-Europe cargo train link. Chengdu is expected to have the largest cargo train depot in China

- International presence – With 14 consulates (ranked #3, after Shanghai and Guangzhou), Chengdu has the largest international presence in Southwest China

- Presence of Fortune 500 companies – 299 Fortune 500 companies have already built up a presence in the province of Sichuan, most of them are located in Chengdu

Consequently, demand for real estate in Chengdu has been increasing, especially in the core areas of the city. For example, the average office and residential prices in Chengdu’s core areas increased by about 25% over the past two years, which is significantly above the national average. However, the absolute prices are still comparatively moderate, and it is expected that the growth trend continues.

It is important that investors understand the strategic importance of China’s economic development plans and the consequential trends. China’s center of economic development is clearly heading westward, and the next era of strong growth is expected to be in that region. As illustrated by the example of Chengdu, the country’s Go-West policy and the BR initiative have already vividly accelerated the growth and transformation of some Western cities, with a trend poised to continue.

Investors should consider the arising opportunities in China’s Western regions and to capitalize on the major economic shifts that are already underway. As always, it is important to understand the strategic development plans of the government and to align investment strategies accordingly.

Sources

ADB; asean.org; Bloomberg; CB Richard Ellis; China Daily; CEIC; Centaline; CitiBank; CNN; Colliers International; Credit Suisse Research; Cushman & Wakefield; Deloitte; Diener Syz Real Estate; DTZ Research; Economist Intelligence Unit; Financial Times; Franklin Templeton; Frost and Sullivan; GaveKal Dragonomics; IMF; institute for building efficiency; Jakarta Post; Jones Lang LaSalle; Knight Frank Research; KPMG; LaSalle Investment Management; McKinsey Global Institute; Morgan Stanley Research; National, Provincial, and Municipal Bureaus of Statistics; Nomura Research; OECD; People’s Bank of China; Political & Economic Risk Consultancy Ltd; PricewaterhouseCoopers; ResearchGate; Reuters Real Estate; Savills; Shanghai Daily; Thomson Reuters; Trading Economics; UBS Research; UN; Wall Street Journal; WTO; World Bank; World Energy Outlook (IAE); Xinhuanet

Unsere umfassenden Artikel informieren Sie über aktuelle Entwicklungen auf dem asiatischen Immobilienmarkt und wichtige Trends in der Immobilienbranche. Für eine automatische Zustellung, dürfen Sie sich gerne hier einschreiben.